Report Table of Contents:

Part 1: Overview 1

E.1 Introduction 1

E.1 Established Millimeter Wave Markets 1

E.2 Technology & Hardware 2

E.3 Regulation and Public Policy 3

E.4 Imaging 3

E.5 Telecommunications 5

E.6 Consumer Markets 6

E.7 Defense and Security Radar 7

E.8 Other Millimeter Wave Markets 7

E.8.1 VSATs 8

E.8.2 Medicine and Health 9

E.8.3 Chemical Monitoring 9

E.8.4 Construction and Infrastructure 10

E.8.5 Manufacturing 10

Part 1: Overview 11

1.1 Introduction 10

Figure 1-1 Primary US Microwave and Millimeter Wave Band Allocations 11

1.2 History 14

Figure 1-2 Prof. J.C. Bose with his millimeter wave equipment, 1897 15

1.3 Technology Basics 16

Figure 1-3 Propagation of Millimeter Waves 17

Figure 1-4 Absorption of Millimeter Waves by Atmospheric Oxygen & Water Vapor 19

Figure 1-5 Overall Atmospheric Absorption Mechanisms of Electromagnetic Radiation 20

Part 2: Technology and Hardware 22

2.1 Semiconductors and Packaging 22

2.1.1 Material Systems: GaAs, GaN, SiGe and CMOS 22

2.1.2 Packaging: MCM vs. SMT 29

2.1.3 Devices, Circuits & Components 29

2.1.4 RF-MEMS Switches 30

2.2 Transmission Lines 31

2.3 Antennas 32

2.4 Transceivers & Receivers 33

2.5 Systems 34

2.6 Modulation 34

2.6.1 Amplitude Shift Keying 35

2.6.2 Frequency Shift Keying 36

2.6.3 Orthogonal Frequency Division Multiplexing 36

Part 3: Technical and Safety Issues 38

3.1 Technical Issues 38

3.2 Safety 41

Part 4: Public Policy, Regulation, and Standards 44

4.1 Background: Growth of the Current Regulatory Climate 44

4.2 Recent FCC Rule Changes 45

4.3 E-band Regulation 47

4.4 The Effect of Local Government 49

4.5 Standards 50

4.5.1 Low Frequency Options 50

4.5.2 Higher Frequency Standards 53

4.5.3 Summary 59

Part 5: Application Summary 60

5.1 Introduction – Why Millimeter Waves? 60

5.2 Today’s Marketplace 61

5.2.1 Telecommunications 61

5.2.2 Radar 63

5.2.3 Imaging 64

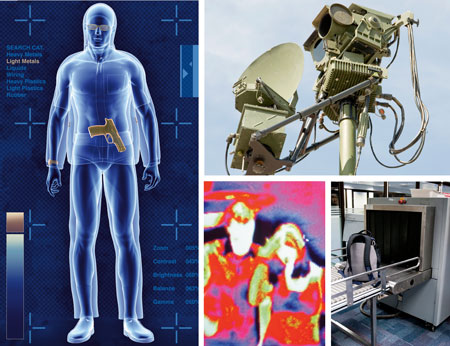

Part 6: Imaging 65

6.1 Introduction 65

6.2 Imaging Technology 66

Figure 6-1 Scissors Imaged Through a Closed Container 67

Figure 6-2 Cookies Imaged Through a Closed Container 67

6.3 Imaging Applications 69

6.3.1 Checkpoint Security: Airports & Other Public Venues 69

Figure 6-3 Hidden Ceramic Knife 73

6.3.2 Inventory Control, Theft Prevention 75

6.3.3 Through-Wall Imaging 76

6.4 Active vs. Passive Systems 79

6.4.1 Technical Comparison 79

6.4.2 Application/Market Comparison 84

Figure 6-4 Checkpoint Security Imaging Market, Active vs. Passive System Share 86

6.5 Issues of Acceptance: Privacy and Public Perception 86

Figure 6-5 Active millimeter wave images 87

Figure 6-6 TSA Chart on Millimeter Wave Scanners 89

6.6 The Competition: Backscatter X-Ray 90

6.7 Millimeter Wave Imaging Markets 92

6.7.1 Market Development 93

6.7.2 Checkpoint Security Imaging Markets 95

Figure 6-7 Millimeter Wave Imaging Systems Sales in Checkpoint Security, Unit Sales 98

Figure 6-8 Millimeter Wave Imaging Systems Sales in Checkpoint Security, Market Volume 98

6.7.3 Inventory Control and Loss Prevention Imaging Markets 99

Figure 6-9 Imaging Systems Sales, Loss Prevention, Unit Sales 100

Figure 6-10 Imaging Systems Sales, Loss Prevention, Market Volume 100

6.7.4 Through-Wall Imaging Markets 100

Figure 6-11 Millimeter Wave Through-Wall Imaging Systems, Market Volume 101

6.7.5 Consumer Retail Imaging Markets 101

Figure 6-12 Imaging Systems Sales in Consumer Retail, Market Volume 101

6.7.6 Handheld Systems 102

Figure 6-13 Handheld MMW Imaging System Sales, Unit Sales 103

Figure 6-14 Handheld MMW Imaging System Sales, Market Volume 103

6.7.7 Summary: Imaging Market Growth 103

Part 7: Telecommunications 86

7.1 Introduction 105

7.1.1 Conventional Microwave Links 107

Figure 7-1 Conventional Microwave Links, Market Volumes 108

Figure 7-2 Conventional Microwave Links, Unit Sales 108

Figure 7-3 Conventional Microwave Links, Hardware Sales by Componen 109

Figure 7-4 Relative Share of Mobile vs. Enterprise Networks, 6 - 38 GHz, 2016 109

7.1.2 The advent of Millimeter Wave Systems in Telecommunications 109

7.2 5G: Backhaul and the Small Cell Model 115

7.3 Licensed vs. Lightly Licensed vs. Unlicensed 119

7.4 The 23, 24, 26 and 39 GHz Bands 121

7.4.1 23 and 26 GHz Bands 122

7.4.2 24 and 39 GHz Bands 122

7.5 60 GHz 123

7.5.1 60 GHz Telecommunications Applications 125

7.5.2 Short Range: WiGig and WirelessHD 126

7.5.3 Benefits of 60 GHz Technology 129

7.6 The E-band 130

7.6.1 Background 130

7.6.2 Propagation Characteristics 132

7.6.3 Performance, Reliability and Availability 133

Table 7-1 Five Nines Link Range and Availability for Several Cities 134

7.6.4 Applications & Users 136

Table 7-2 Frequency vs. Beamwidth at 1 km using a 1 foot diameter antenna 137

Figure 7-5 Beamwidth comparisons for wireless backhaul solutions 139

7.6.5 E-band Licensing 143

7.7 The Competitive Technology Landscape 144

Figure 7-6 Telecommunications Backhaul: Shares by Technology 145

7.8 The Millimeter Wave Telecom Market 146

7.8.1 Past Market Growth 146

7.8.2 The Shift to backhaul 147

7.8.3 WISPs: Fixed Wireless Internet Access 148

7.8.4 Present and Future Market Growth 157

Figure 7-7 Markets, Millimeter Wave Telecommunications Links, 20 to 38 GHz 158

Figure 7-8 Markets, 20 to 38 GHz, by Component 158

Figure 7-9 Millimeter Wave Systems Markets, Telecom, 60 GHz 160

Figure 7-10 Telecom Systems Markets by Component, 60 GHz . 160

Figure 7-11 Millimeter Wave Systems Markets, Telecom, 60 GHz, Unit Sales 161

Figure 7-12 Millimeter Wave Systems Markets, Telecom, E-band 161

Figure 7-13 Telecom Systems Markets by Component, E-band 162

Figure 7-14 Millimeter Wave Systems Markets, Telecom, E-band, Unit Sales 162

Figure 7-15 Millimeter Wave Systems Markets, 60 GHz, by Application 163

Figure 7-16 Millimeter Wave Systems Markets, E-band, by Application 163

Figure 7-17 E-band Enterprise Markets, Government/Municipalities, General Business 164

Figure 7-18 E-band Enterprise Markets, Healthcare, Education, Misc 164

Part 8: Consumer & Automotive 165

8.1 Introduction 165

8.2 60 GHz Systems: Consumer & Home Media 166

8.2.1 Background: 60 GHz in Multimedia 166

8.2.2 Data Compression 168

8.2.3 Hardware Considerations 169

8.2.4 60 GHz Consumer Media and Other Markets 170

Figure 8-1 Markets for 60 GHz Consumer Multimedia Products 173

Figure 8-2 Markets for 60 GHz Consumer Multimedia Products, Unit Sales 173

8.3 Automotive Millimeter Wave Radar 173

8.3.1 Background: Millimeter Wave Radar 173

8.3.2 MMW Radar Applied to Transportation 175

8.3.3 History_ 178

Figure 8-3 The 1959 Cadillac Cyclone with Radar 179

8.3.4 MMW Radar Technology 181

8.3.5 24 GHz vs. 60 GHz vs. 77 GHz vs. 79 GHz 184

Table 8.1 Assigned Tasks by Band 187

Figure 8-4 Market Share, Auto Radar, 24 GHz vs. 77 GHz, Automobiles 188

Figure 8-5 Market Share, Auto Radar, 24 GHz vs. 77 GHz, Trucks 189

8.3.6 Infrastructure and Vehicle-to-Vehicle Communications 190

8.3.7 The Competition 191

8.3.8 Automotive Radar Markets 192

Figure 8-6 Worldwide Unit Sales, Cars and Trucks 194

Figure 8-7 Unit Sales, Radar Systems, Trucks and Automobiles 195

Figure 8-8 Markets for Automotive Radar, 24 GHz and 77 GHz 195

Part 9: Millimeter Wave Defense & Security Markets 197

9.1 Background 197

9.2 Millimeter Wave Radar for Security and Intrusion Detection 198

9.2.1 Perimeter and Surveillance Radar 199

9.2.2 Range Considerations 202

9.2.3 Technical Considerations 202

9.3 Munitions Applications 203

9.4 Marine Radar 204

9.5 Defense and Intelligence Communications 205

9.6 Active Denial Systems and Non-Lethal Weapons 206

9.7 Defense & Security System Markets 207

Figure 9-1 Surveillance/Perimeter Radar, Defense vs. Non-Defense, 2016 208

Figure 9-2 Millimeter Wave Surveillance/Perimeter Radar Markets 208

Figure 9-3 Millimeter Wave Munitions Radar Markets 209

Figure 9-4 Marine Radar Millimeter Wave Markets 210

Figure 9-5 Defense & Intelligence Millimeter Wave Communications Markets 210

Figure 9-6 Overall Defense & Security Markets 211

Part 10: Other Millimeter Wave Markets 212

10.1 Commercial Ka-band Satellite Communications 212

Figure 10-1 Unit Sales, VSAT Terminals 217

10.2 Medicine and Health 218

Figure 10-2 Millimeter Wave Markets in Medicine, Health and Safety 221

10.3 Chemical Monitoring 221

Figure 10-3 Markets for Millimeter Wave Systems in Chemical Monitoring 222

10.4 Construction & Infrastructure 222

Figure 10-4 Millimeter Wave Systems Markets in Construction and Infrastructure 223

10.5 Manufacturing 224

Figure 10-5 Millimeter Wave Markets in Manufacturing 225

Part 11: Millimeter Wave Semiconductor Markets 189

11.1 Introduction 226

11.2 The Evolving Semiconductor Landscape 226

Figure 11-1 Overall MMICs by Application, All Frequencies, 2020 231

Figure 11-2 MMIC Sales by Application, Millimeter Wave Only, 2025 232

11.3 Consumer Applications 232

Figure 11-3 Semiconductor Markets in Car Radar, Multimedia 232

11.4 Imaging 233

Figure 11-4 Millimeter Wave Semiconductor Markets, Active Imaging Systems 234

Figure 11-5 Millimeter Wave Semiconductor Markets, Passive Imaging Systems 234

11.5 Defense and Security 234

Figure 11-6 Defense & Security Millimeter Wave Semiconductor Markets 235

11.6 Telecommunications 235

Figure 11-7 Telecommunications Millimeter Wave Semiconductor Markets 236

11.7 Other Millimeter Wave Applications 237

Figure 11-8 Semiconductor Markets in Other Millimeter Wave Applications 237

Order today

#MMW4—Millimeter Waves: Emerging Markets

$4,800

|